Posted & Reviewed by C.J. Baker - May 10th 2024

Getting into a car accident can be an unnerving experience, leaving you feeling overwhelmed and unsure of the next steps to take. One of the biggest early questions is this: Do I have to report this accident to my car insurance company?

Legally, not always. But practically? Almost always.

In Texas, failing to report an accident does not break the law, but it can leave you exposed financially, legally, and in your fight to get compensated. So in actuality, whether you plan on filing an insurance claim, or if you just want to protect yourself from a future lawsuit, how and when you report an accident matters.

At Armstrong Lee & Baker LLP, we are experienced Houston car accident lawyers ready to advocate for you. Contact us today for a free consultation.

When you are involved in a car accident, it is generally recommended to report the incident to your insurance company as soon as possible. While the specific guidelines regarding reporting vary by policy, failing to report a car accident to your insurance company can have serious consequences.

Insurance policies typically require policyholders to promptly report any accidents as a condition of coverage. Failure to comply with this requirement could result in a denial of coverage, leaving you responsible for the damages and potentially facing legal consequences. So, while reporting is not legally required per se, it essentially practically required if you want to stay safe, and insured.

Here’s another wrinkle of which to be aware: Insurers often record your statements, even during what feels like a routine phone call. And those recordings can later be used to limit or deny your claim. That is why, when you do decide to report your accident, it is always safer to have your lawyer make the call for you.

Auto insurance policies almost always contain vague, albeit strict, language like “report promptly” or “notify us within a reasonable time.” In Texas, while such phrases are interpreted based on the situation, do not expect much leeway. Most insurers will consider two or three days a “reasonable amount of time,” unless you were hospitalized or incapacitated.

And what happens if you miss that window? Nothing good.

In that case, your insurer may deny your claim – even if liability is clear-cut. Worse, they might raise your premiums, flag your policy for non-renewal, or even cancel it altogether. If you are thinking, “But I did not cause the accident,” that does not matter either. Failure to report can be considered a breach of the insurance contract, and that is valid justification for its cancellation.

Let’s say you are rear-ended and do not report it because you feel fine and it wasn’t your fault. But then, a week later, your back starts hurting. If the other driver’s insurance fights your claim and your insurer never got notice (because you never gave it to them), you could be on your own. That simple fender bender could cascade into months of bills, sans coverage.

As indicated, under Texas law, it is not illegal to skip reporting a crash to your insurance company, but again, that does not mean you are in the clear.

If the accident involved injuries, a death, or property damage of more than $1,000, Texas law requires that the crash be reported to law enforcement. That means calling the local police, sheriff, or Department of Public Safety. If officers come to the scene and file a report, you are covered. If they do not, then you must file a written crash report with TxDOT (Form CR-2, often called the “Blue Form”) within ten days. Failing to do this can lead to misdemeanor charges, fines, or even suspension of your driver’s license. And if the vehicles are not drivable at the time of the crash, you are legally required to stay at the scene and wait for law enforcement.

Separately, your insurance company expects notice of the accident under your policy contract. That is different than state law, but it is nevertheless a condition of coverage. Even if the law does not require you to notify the police, your insurer may still deny your claim if you fail to report the accident to them in a “reasonable” amount of time.

Finally, consider the civil side. If, down the road, someone sues you but you never filed a report, it may look like you were trying to hide something. That perception can damage your credibility, as well as your defense. Even a minor claim can snowball if the other side is able to paint you as negligent, evasive, or uncooperative.

Not every car accident in Texas needs to be reported. The law generally does not require police reports or crash filings when:

In these situations, you are not legally required to file a state crash report or call the police. And if you are confident the other driver will not file a claim, you might decide not to notify your insurer either.

But, yes, even these “it was nothing” cases, can sometimes come back to haunt you. That sore neck might turn into nerve damage. That polite stranger might lawyer up down the road. In cases like that, if you never filed anything, your insurer could refuse to help.

Given this, even in seemingly minor cases, reporting is still the safer choice.

Texas law says that if a crash causes death, injury, or property damage of $1,000 or more, it must be reported to law enforcement within 10 days using the CR-2 crash report form (that same Blue Form). In practice, most people call the police from the scene and that satisfies the requirement.

Insurers, on the other hand, expect notification much faster. Most policies call for “prompt notice,” which usually means within 24 to 72 hours. Although there is no fixed legal deadline, the earlier you report, the safer you are. Delayed reporting raises red flags, especially if you are later making an injury claim.

The consequences of missing these deadlines are not insignificant. If you do miss them, you might be fined (for violating state law), denied coverage (for violating your policy), or barred from suing (if the statute of limitations runs out and you never preserved your claim).

So don’t miss them!

While it might not be against Texas state law, there are clearly some legal implications of not reporting a car accident to your insurance company. Failing to do so can

As such, if you are in doubt, report, and even better, report through your lawyer.

Choosing the right car accident lawyer is important to ensuring that your rights are protected and that you receive the compensation you deserve. Contact Armstrong Lee & Baker LLP, the leading Houston car accident lawyers, for legal representation. Trust our team to fight for you and provide the personalized attention and support you need during this challenging time.

Don’t wait – contact us today to schedule a consultation. Let us be your trusted advocates in seeking justice after a car accident.

C.J. Baker represents victims with serious injuries and he won’t let any corporation or insurance company stop his clients from getting complete justice. He has won millions of dollars for victims of 18-wheeler crashes, oilfield equipment failures, offshore platform explosions, and defective medical devices. Our lawyers have 25+ years of combined experience.

This page has been written, edited, and reviewed by a team of lawyers following our comprehensive editorial guidelines. Our lawyers have more than 20 years of legal experience as personal injury attorneys.

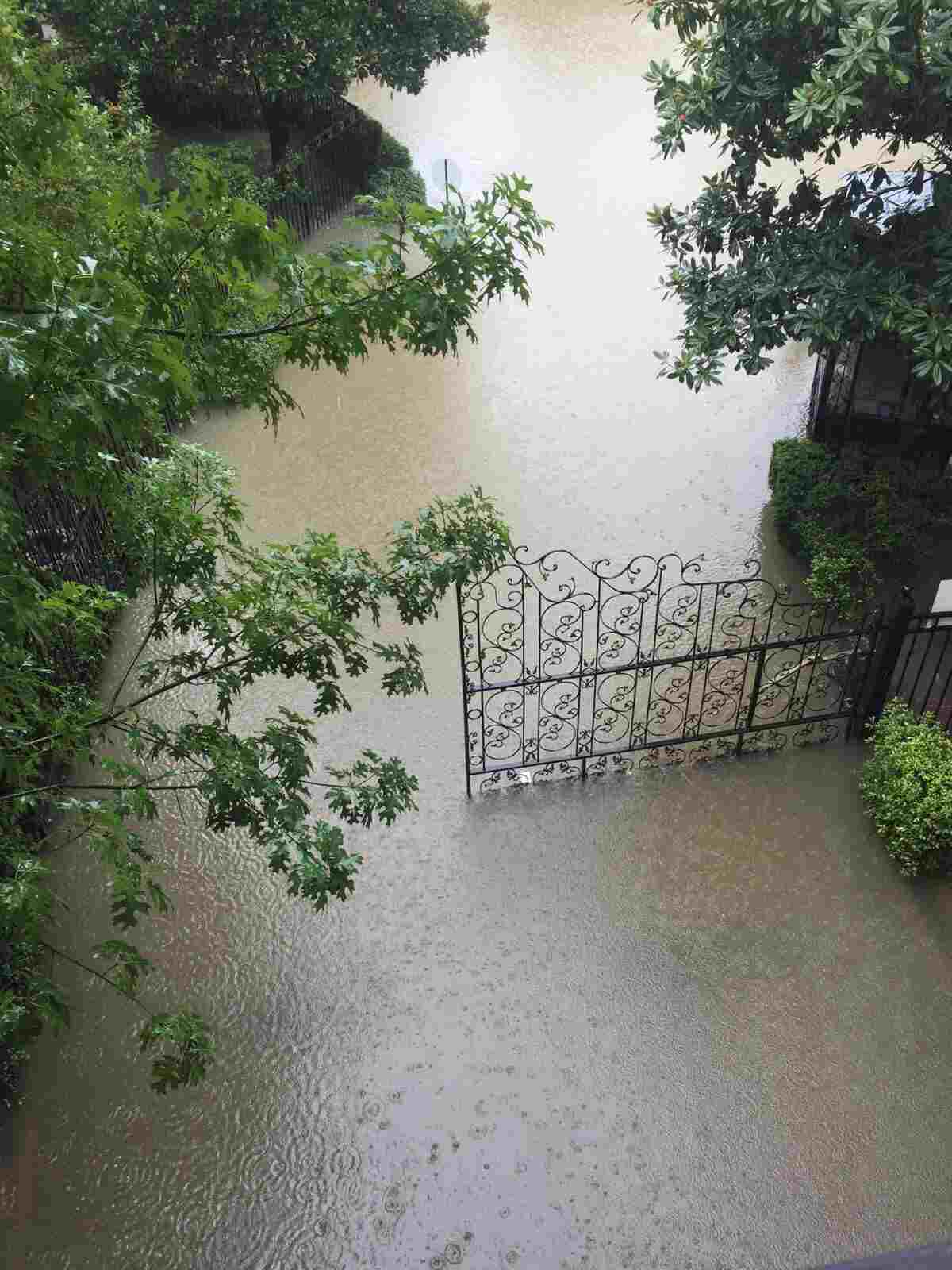

What You Need to Know About HB 1774, Effective September 1, 2017 In the face of the worst flooding event in Houston’s history, countless social media rumors ...

Posted by Scott Armstrong

New Law Unlikely to Apply to Home Flood Damage Claims, but Will Impede Meritorious Wrongful Denial and Delay Claims We hope that you and your family are safe. Today...

Posted by Scott Armstrong

If you are seriously injured in a car accident, you will have to deal with your own insurance as well as the other driver’s insurance. Worrying about contact...

Posted by Scott Armstrong

Trusted Personal Injury Attorneys in Houston

Schedule your free consultation with a top-rated Houston personal injury lawyer today