Posted & Reviewed by Scott Armstrong - Dec 05th 2021

If you’ve turned on a television in the last decade, you have undoubtedly seen a little green reptile offering to save you a bunch of money on your car insurance.

Over the last 25 years, that little reptile has grown into an insurance powerhouse. In fact, GEICO, formally known as the “Government Employees Insurance Company” is now the second largest auto insurance company in the U.S.

But with its large size also comes large bureaucracy. If you are in an accident, how can you even get GEICO’s claim department on the phone? With over 17 million insured drivers on its books, if you’re in an accident, you are likely to be dealing with GEICO in some capacity.

So how do you deal with GEICO claims after an accident? The most efficient way is to hire a car accident attorney.

In this post, the Armstrong Lee & Baker LLP team will walk you through how to deal with GEICO claims after a car accident. As experienced Texas GEICO claims lawyers, we know what it takes to negotiate with even the toughest insurance companies after an accident.

All insurance companies make money by paying less out for claims than they collect in premiums. GEICO is no exception. Insurance adjusters try to get claimants to accept a settlement that is less than what their claim is worth.

Depending on the person’s losses, this can rob an accident victim of thousands—possibly millions—of dollars. Before you do much more than speak to GEICO customer service and get a GEICO claim number for your accident, speak with a personal injury lawyer.

As with any insurance company claim, you will want to have a few pieces of information handy when speaking to GEICO’s claim department. Helpful information includes:

The more information you have immediately available about the accident, the better. Insurance companies want to pay claimants as little as possible. It is more difficult for them to deny claims when you have a robust file on your accident.

When you file your claim, or have any interaction at all with the insurance company’s claims department or GEICO customer service, do not allow yourself to be sucked into conversation.

Never agree to give a recorded statement. If you describe the accident in an inconsistent manner, or exaggerate any detail, this can later be used against you.

If GEICO presents you with any settlement paperwork, do get a legal opinion. Do let anyone affiliated with the claim know that you are speaking with a lawyer. You should also seek medical advice if you have any lingering injuries.

Check with a doctor if you were not examined shortly after your accident. Make sure to keep all records, files, receipts, and contact details related to the accident. You may want to keep things even if they do not seem like they are important at the time!

At Armstrong Lee & Baker LLP, we have helped accident victims all over the Houston metroplex area negotiate insurance settlements with GEICO and all the major auto insurance carriers.

We know all the ways that insurance companies try to trick accident victims out of the compensation they are rightfully owed. Our individualized, client-centered approach helps make insurance settlement negotiations a smoother process.

We are also not afraid to fight for your rights in court if necessary. Contact us today for a free case consultation to discuss your options.

Scott Armstrong is the Managing Partner and co-founder of Armstrong Lee & Baker LLP. Known for his strategic insight and relentless pursuit of justice, Scott personally guides the firm’s approach to complex cases, including catastrophic injuries, vehicle accidents, workplace injuries, and product liability. His leadership has created a culture where excellence, innovation, and dedication to client success are paramount, and his influence is evident in every case the firm handles, often resulting in hundreds of millions recovered for clients.

This page has been written, edited, and reviewed by a team of lawyers following our comprehensive editorial guidelines. Our lawyers have more than 20 years of legal experience as personal injury attorneys.

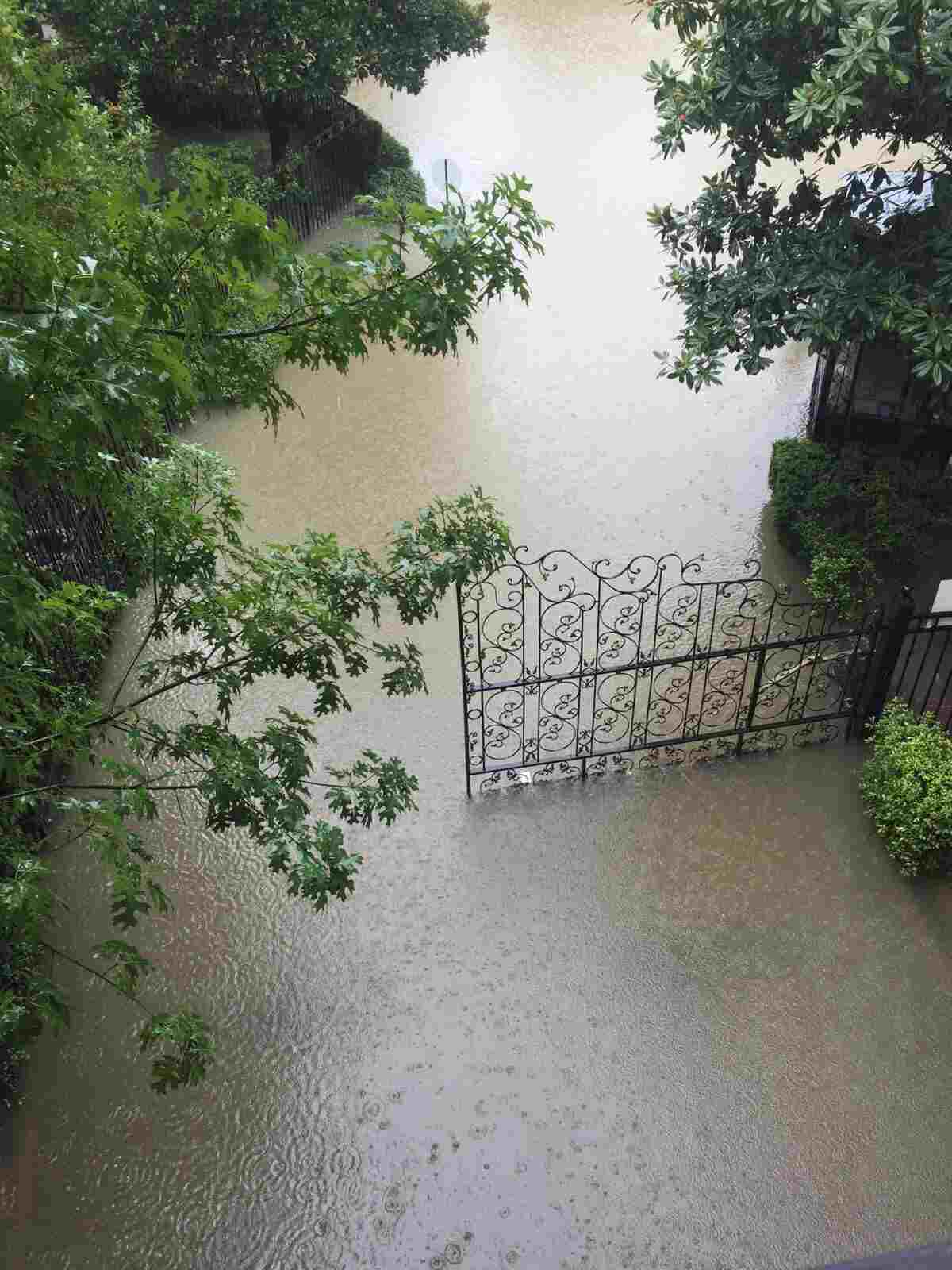

What You Need to Know About HB 1774, Effective September 1, 2017 In the face of the worst flooding event in Houston’s history, countless social media rumors ...

Posted by Scott Armstrong

New Law Unlikely to Apply to Home Flood Damage Claims, but Will Impede Meritorious Wrongful Denial and Delay Claims We hope that you and your family are safe. Today...

Posted by Scott Armstrong

If you are seriously injured in a car accident, you will have to deal with your own insurance as well as the other driver’s insurance. Worrying about contact...

Posted by Scott Armstrong

Trusted Personal Injury Attorneys in Houston

Schedule your free consultation with a top-rated Houston personal injury lawyer today